Key Features of Accounting Software

Regardless of the industry your business is in, or the size, it is vital that you have appropriate accounting software.

It is a huge improvement over using manual methods and spreadsheets, as software can save you time and effort, and will be more accurate.

Why Use Accounting Software?

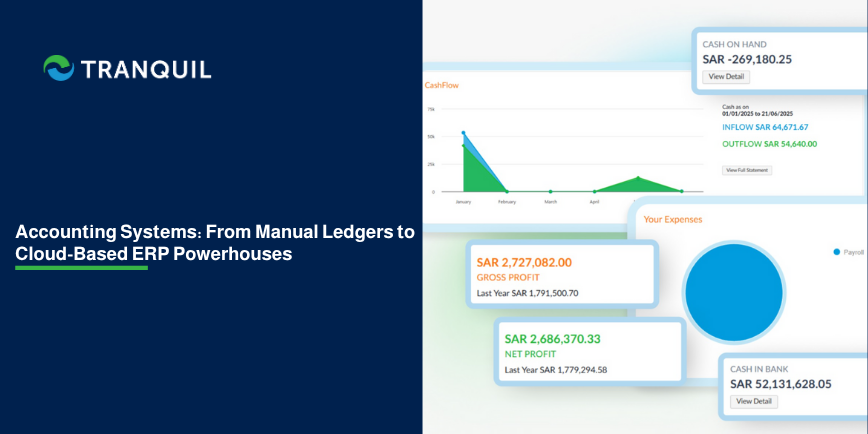

The biggest benefit offered by accounting software is the improved efficiency, and having all your information in a centralized location, allowing you to easily see your spends and incomes, and to know where to find that information.

The software can be connected to your bank accounts so that you can avoid manual data entry of transactions; the dashboard will give you a real-time view of the most critical metrics.

Accounting software solutions can churn out several types of reports and financial statements like the profit and loss statement and balance sheets, which are a must for many reasons: to ascertain the company’s financial health, inspire investor confidence, form business strategies, and also to comply with regulations.

Statements can be compared with those of the previous financial periods to determine how well the business is progressing – or not; this can help you to take informed decisions for business growth.

By implementing accounting software, you can automate monotonous and time-consuming tasks and divert your employees’ time towards more productive or value-adding tasks.

It categorizes transactions, increases efficiency of your book-keeping, and help you monitor all transactions efficiently, managing your tax flow properly.

Today, accounting software has evolved tremendously, and there are several solutions available today.

Deciding which one to purchase can be daunting; how will you choose?

You need to check the features being offered, and what your business requires.

ALSO READ: Accounting Problems and Solutions

Features of Accounting Software

Here are the important features of accounting software that you need to look for:

1. Security

It goes without saying that the solution has to be secure – after all it will deal with financial and personal information of customers and/or vendors.

This is the most important of all the accounting software features, so you must ensure that the security is iron-clad.

2. Cloud Computing

Accounting software can be installed either on your own servers or on remote servers (cloud).

Cloud computing offers innumerable advantages to a business, and hence it makes more sense to go with a cloud-based solution like Tranquil.

It facilitates remote work and collaboration, allowing the business to engage freelancers instead of hiring a full team in-house.

Secondly, the software is automatically updated by the vendor; any new features, bug fixes, and so on, are automatically done.

Moreover, you don’t have to incur expenses in upgrading your hardware to implement it.

3. User-friendliness

In small and medium-sized companies, the accounting software is likely to be used by admin staff rather than actual accountants, and they may not have any financial expertise.

But if the software is intuitive, your admin staff will be able to take care of these things easily.

Firms that do have accountants can do more value adding tasks like supervise, conduct a detailed analysis, and more.

ALSO READ: Accounting Trends for 2023

4. Scalability

Is your software future-ready?

Innovations are happening at a rapid pace now, with increased automation and speed being at the forefront.

A growth-oriented business must implement accounting software that is scalable and will be able to handle the extra workload when the business grows; this could be in the form of more transactions, users, vendors, customers, currencies, and so on.

With higher volumes of financial data being generated, it is all the more necessary to use specialized tools and automation.

5. Integrations

Look for accounting packages that offer integrations with third-party software your business uses or is likely to use, and this will be a huge time and money saver for your company.

It could be for automatic invoice charging and reconciliations with which all you have to do is set up the invoices, and the software does the needful on the due dates.

ALSO READ: Guide on Budget Variance Analysis

6. Mobile Friendly

With mobile penetration increasing by the day, it is absolutely necessary for you to ensure that your software is mobile-friendly.

This will help your customers offer mobility to their customers, adding to their convenience.

Does your software offer a mobile app? That’s a huge plus.

7. Invoicing and Payment Processing

Billing and processing payments are important software accounting features that will help your business greatly.

At a glance, this will tell you the amount owed to you or the amount you owe others – along with printing and emailing invoices.

The system stores basic information on your vendors and customers like name and contact information, payment terms, etc.

These may seem simple but it helps you save a great deal of time and effort, allowing you to focus on core business tasks.

ALSO READ: What is Cashbook in Accounting?

8. Bookkeeping Capabilities

Efficient accounting software will take care of routine book-keeping activities like:

- Updating ledger entries

- Tax calculations

- Bank reconciliation

- Asset depreciation tracking

- Handling payroll and deductions

To be able to perform these tasks, the software must have these features:

9. General Ledger

This is the primary accounting book maintained by any business; accounting also includes things like account charts, tax management, payroll, reports, invoicing, and more, and all these must be included in accounting software.

Ideally, the software should also help to maintain compliance with financial regulations.

The general ledger feature of software accounting systems includes important information regarding all the financial transactions of a business, and is very similar to conventional bookkeeping, but is more efficient.

It can manage everything from accounts payable and receivable to calculating tax to reconciling bank statements and generating financial statements, and even helps in managing the cash flow.

The ledger contains details of vendors and customers like bank accounts, invoices, modes and terms of payment, and so on.

10. Accounts Payable

We have already mentioned this, but a little detail is necessary, because it is a critical matter.

You don’t want to fall behind on your payments and incur fines and lose your reputation.

When accounts payable are part of your accounting software, you can also access your complete vendor data quickly.

This feature should include the following:

- Purchase orders tracking all orders with quotes that have to be processed

- Automatic payments that allow scheduling of payments, and drafts with complete details

- Credit memos given to vendors for easy tracking and determining the financial position

ALSO READ: Credit Note vs Debit Note

11. CRM Capabilities

If your accounting software has automated invoice emailing capability and can follow up with reminders at set intervals, it can also serve as a tool to manage your relationships with customers with regard to the financial aspect of your business.

12. Financial Reporting and Projections

Accounting software contains all your financial information; ergo, it makes sense that you should be able to make use of this to generate reports and create projections, delivering valuable insights and BI.

In fact, reports are essential in today’s competitive business environment.

Moreover, being able to easily access proper records and reports can help you to perform critical tasks and conduct meetings more efficiently.

Accountants can offer a detailed analysis of such reports and craft a tailored growth plan for your business, and these can help the management to a great extent.

Reports also help to keep track of the financial health of your business.

ALSO READ: Ways to Increase Procurement Process

Benefits Of Accounting Software

Accounting software is a lot more than a necessity in today’s world.

It provides several features that facilitate the smooth functioning of business.

Let’s take a look at how your business can benefit from implementing such a solution:

1. Exercise Control Over your Finances

You can manage your personal finances however you want, but when it comes to your business, you need a formal and proper system.

While manual management with pen and paper and spreadsheets can help, it is incapable of delivering insights that help you take better decisions than a software solution can.

The software organizes your financial data and stores it centrally, giving you a comprehensive view of the financial performance of your business in real-time.

ALSO READ: Guide on Cloud migration

2. Invoice Automation

To ensure proper cash flow and business growth, it is essential to bill customers on time; it becomes progressively difficult to collect if you keep waiting.

Reliable accounting software programs will feature automated invoicing.

In fact, you may even be able to set up recurring invoices, configure reminders to follow up with payments, along with accepting digital payment from the invoices directly.

Most software will even allow you to track invoices that remain unpaid, and offer discounts as a motivation for customers to pay early.

ALSO READ: Second Phase of E-invoicing in Saudi Arabia

3. Track Expenses

For small and even some medium-sized businesses, cash is crucial. Unfortunately, many businesses fail to keep a proper track of business expenses.

You don’t want a shortage in cash flow because your expenses are not recorded properly.

Such situations will not arise when you implement an efficient accounting software that has automated tracking of expenditure.

Receipts can be scanned and recorded, and mileage and expenses incurred for customers can be tracked properly.

4. Bank Statement Reconciliation

It is imperative that your accounting software can connect with your bank accounts so that you can access bank statements from the software, and have automated reconciliation of bank statements.

5. Helps to Maintain Compliance

Maintaining compliance can be difficult in a scenario or rapidly changing and tightening regulations; robust financial accounting software like the one from Tranquil can help you comply with all regulations with regular updates, automated tax calculations, etc.

ALSO READ: ERP Upgrade: Importance and Benefits

6. Reporting and Analysis

Accounting software collects huge volumes of data through integrations with your business integrations, POS etc., giving you in-depth business insights.

Reliable accounting software also include robust reporting functions, allowing easy analysis of data and performance tracking.

7. Inventory Management

This is critical for any business dealing in inventory; you need to ensure that you don’t end up with dead stock or unsellable inventory, or run out of popular products either.

Accounting software helps to track the quantity of products sold, configure reorder levels, and generate reports on both fast-selling and slow-moving products, and also automate your ordering process.

8. Eases Accounts’ Work

Accounting software organizes your data, storing it centrally, scans receipts, files tax forms, and tracks inventory, simplifying the work of accountants.

This saves a great deal of time and they can perform more value adding tasks.

ALSO READ: Critical Factors for a Successful ERP Implementation

9. 24/7 Access

Tranquil ERP is a cloud-based solution which lets you access it from any place you have internet connectivity.

This lets you check any transaction, prepare invoices, generate reports, and accept payments regardless of where you are.

Conclusion

It goes without saying that accounting software is absolutely essential to streamline your accounting process, and to gain a competitive edge in the market.

Tranquil ERP has a robust, feature-rich financial accounting module that will help your business have smooth cash flows, prepare accurate financial statements and a whole lot more. Do schedule a FREE demo at a time of your convenience to see for yourself. Our team will be happy to answer all your queries.