Accounting Trends for 2023

In 2022, the business world witnessed several changes in the way accounting was done; these changes, while not being jaw-droppingly exceptional, have set the tone for several more innovations for the coming year.

Technological advancements are happening in every field, and we can see the increased adoption of automation.

While tech has not yet brought in the kind of sea changes it has in other fields, there is no doubt that even this arena is fast moving towards greater automation and adoption of innovative technology.

The emergence of cloud computing has increased the possibilities of adoption for accounting.

ALSO READ: ERP Trends

Drive Towards Industry Change

In 2019, a global survey of accountants was conducted, in which over 3000 respondents participated; a whopping 905 % of them were of the opinion that by the next decade, accounting will undergo a major cultural shift.

This shift is being caused by business services, hiring practices, remote working practices, and emerging technologies.

Another surprising result of this survey was that the majority of accountants would begin to hire staff from divergent backgrounds, and those with conventional accounting backgrounds may not remain the favored breed anymore.

They also believed that in spite of the various training programs that are available for accountants, they won’t suffice to bring them up to speed with the accounting trends for the next decade.

Sounds interesting? We are sure you want to know more.

Without much further ado, let us now look at the accounting trends for 2023.

ALSO READ: How Does Landed Cost Affect the Cost of Inventory?

Accounting Trends 2023

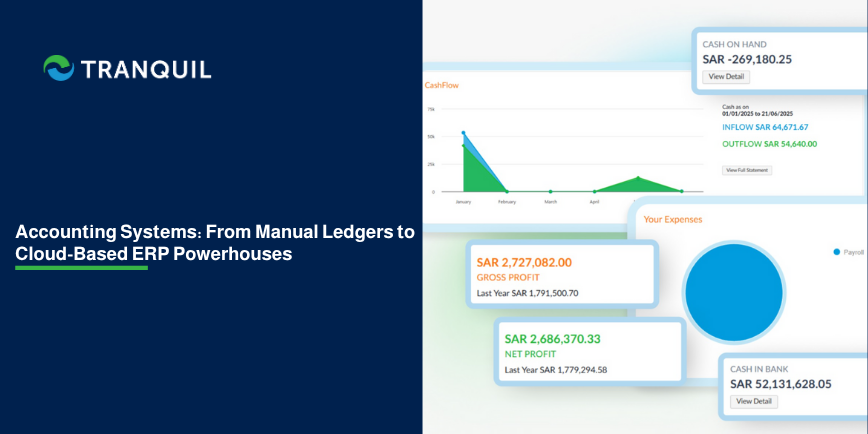

1. Cloud-Based Accounting

This is probably one of the most important accounting industry trends.

Most businesses have shifted to the cloud for business processes like ERP, CRM, etc. as they are secure, quicker, reduce downtime, and hence are more profitable.

The same goes for accounting; with accounting solutions being hosted on the cloud, more and more companies are discovering the convenience of anytime, anywhere access of their digitally hosted system.

The data access not only allows you to view the data, but also to share, edit, copy, and otherwise work on the files and collaborate, subject to your role and responsibility in the organization.

It allows teams to track inventory, sales, expenses, purchases, and payroll, among other things.

Most accountants are happy with cloud-based software as it streamlines their workflows and improves the quality of their work and organizational data.

ALSO READ: What is Job Costing?

2. Offshore Staffing And Remote Work Setup

In the pre-COVID-19 pandemic era, the percentage of remote workers was probably around 10 – 15% globally; however, this figure shot up radically to over 80% during the pandemic.

Even today, many employees prefer to work from home as it saves them commuting time, and they are more productive as the comfort of working from home is incomparable to working in an office atmosphere.

Strangely, there is unemployment among accountants in spite of the requirement for accountants being very high.

This means that several companies are missing the opportunity to hire talented accountants.

To make up for this paucity, finance professionals are moving towards technology to maximize profits for their businesses.

What emerges in this scenario is remote working or work from home.

ALSO READ: Debit Note vs Credit Note

Remote work, in combination with technology in accounting, like digitization and cloud adoption, has helped reduce expenditure significantly, and in optimizing the business progression too.

This trend has been slightly extended with companies now hiring additional employees offshore; some are deployed in remote work configurations after being hired at the office as well.

This model is putting organizations on the fast path to growth; especially for accounting forms, they are able to derive more benefits from this structure in comparison with the conventional working framework.

Based on evaluations and predictions, the offshore and remote working trend is likely to not merely exist, but exponentially increase and thrive in the foreseeable future.

3. Digitization with Accounting Software

There is increased digitization in accounting, and we will see this trend skyrocketing in the coming months.

More and more organizations prefer accounting software rather than manual systems, as the software systems are robust solutions with advanced features and user-friendly functions.

Tranquil Finance and Accounting Software is one such solution that offers numerous functions that help streamline financial accounting, reduce manual effort, minimize errors, and help to save money.

ALSO READ: Detailed Guide to Cash Flow Analysis

4. Big Data

Financial experts and accounting professionals have always depended on big data for taking critical financial decisions.

Technology has played a vital role in the transformation of important internal data sets into the secure and dynamic analysis of data.

It has always helped in converting those assessments into actionable insights.

Thanks to the slow but continuous improvements in the finance sector, there is higher possibility now than ever for data to become more proactive.

This fact is a major catalyst for the changing future of accounting.

5. Data Analytics

While Big Data has been a critical tool with immense potential for financial experts, data analytics is even bigger, with even greater possibilities.

By implementing data analytics in your accounting systems, you can instantly discover inefficiencies in operation, build precise models of forecasting, gain beneficial insights about your finances, and also stay abreast with the progress made by your customers.

By 2023, data analytics will become commonplace as there will be a burning requirement to separate different service values from challengers, and to make precise, data-based decisions, and judgments on that basis.

The main reason being that data analytics is invaluable in deciphering intricate, complicated datasets, and in recording important insights.

It is also believed by industry experts that the rules and frameworks for reliable data gain are set to undergo a significant transformation by 2023.

ALSO READ: What is Budget Variance Analysis?

6. Automated Accounting Process

Automation has radically transformed the way most businesses in various industries function, and accounting is not far behind.

Comprehensive solutions are today available for the whole management process, and this has helped in minimizing errors and bringing clarity to every phase.

As accounting automation depends on computers and servers, many businesses unfortunately get trapped into monetary scams and are vulnerable to cyber security threats.

Ergo, it is essential the auditors in the organization verify the accuracy of the data and financial inputs.

This will help the employees to feel more secure about their jobs and reassure them that they will not be replaced by bots.

ALSO READ: Everything You Need to Know About the P2P (Procure to Pay) Cycle

7. Agile Accounting

This is definitely right up there – one of the biggest trends in accounting for the future.

Agile accounting means how well you react to change and adopt the latest trends seen in the market.

If you are able to evolve rapidly, you will certainly gain a distinct competitive edge.

If you want to succeed and maintain your pole position in the market, it is imperative that you welcome new trends as quickly as possible.

But how can you apply the Agile methodology to accounting?

Agile Accounting Means:

- Managing your time efficiently so that you are able to respond to unexpected changes quickly

- Defining goals and working towards them

- Planning sprints for each fortnight

- Analyzing the successes and failures of every sprint

- Taking advantage of the latest technologies and trends

- Increasing your workforce through means like remote workers, offshore hiring, and more

- Leveraging cloud-driven solutions to have secure, flexible access,

In short, you need to be proactive and be ready to handle anything that the market throws at you.

ALSO READ: What is Asset Depreciation and Why is it Important?

8. Outsourcing Accounting Functions

A novel method of progressing in the accounting field is outsourcing; this helps accounting firms to focus on more critical value-adding tasks and leave the petty issues to others.

When the work becomes too tedious and monotonous, businesses outsource the job to professional firms and can be more productive and increase profitability by making the best use of their resources.

In fact, outsourcing is one of the quickest-growing sectors in accounting, thanks to this fact.

Organizations are beginning to realize that they can get more reliable and accurate accounting services by outsourcing to professional service providers.

It also helps chartered accountants to provide outstanding services to their customers, adding more credibility to their firm and building trust.

ALSO READ: Supplier Aging vs Customer Aging

9. Blockchain

Blockchain has almost revolutionized accounting as we know it.

It has brought down the expenses related to ledger maintenance and reconciliation.

Additionally, blockchain technology now makes it possible for accounting professionals to have clarity and proper visibility regarding their organization’s obligations and the resource availability.

A large number of wallets are being created for blockchain transactions; in the US alone, the spend has touched 1.1 billion US dollars.

No wonder then, that it is definitely a trend that you should keep a watch on; industry experts predict that the day is not far when blockchain sees prolific global acceptance.

ALSO READ: What Is Reverse Factoring?

10. Value-Based Pricing

An accounting firm needs to understand the effect of rising charges on their business.

It can be pretty detrimental, and could even cause them to shut shop.

Value-based pricing, however, uses a tactical approach, where revenues are increased by fine-tuning the price to the amount that is anticipated, rather than its historical amount.

A value-based pricing model is ideal for delivering price certainty for accountants as well as their customers.

Additionally, accounting professionals will be able to make better use of their time and be more productive.

ALSO READ: What is SKU Rationalization?

11. Advisory Services

It is essential for every business owner to stay up-to-date with the latest developments in their industry, the technologies that are emerging, market trends, and so on.

Savvy business owners avail the Advisory Services that guide businesses on how best they can leverage the new technologies and optimize the accounting business, or how to get the most out of their existing accounting software.

Advisory services provide accurate and valuable insights and help boost revenues significantly.

Final Thoughts

These are the trends that most industry experts predict will dominate 2023, and in the years to come in the near future.

The onset of these changes is not sudden, but it is happening slowly and steadily and creating a quiet revolution in the accounting field.

Tranquil Finance and Accounting Management Solution is a cloud-driven, comprehensive, secure, and efficient solution that helps you streamline and automate your accounting procedures, allowing you to tackle complex and value-adding tasks. Tranquil ERP is an integrated solution that also handles your inventory, sales, HR, procurement, and asset management so that you can free your resources from performing monotonous and cumbersome work. Do schedule a demo at your convenience, and we will be happy to show you how Tranquil works, and how it can benefit your business.