What is a Ledger in Accounting? Types and Formats of Ledger

A ledger is a book of entries that contain detailed information of transactions of one account or type of transaction or a summary of all the financial transactions of a company for a specific period.

In other words, the principal account book which contains the balance for each account.

All sets of accounts like nominal, real, and personal, are included in it.

ALSO READ: Benefits of Bank Reconciliation in Accounting

A ledger is the second book of entry which contains everything you need to prepare the trial balance, and profit and loss – the important financial statements for any business.

The entries in the journal are categorized

We have seen that an accounting ledger is basically a catalogue of general accounts within the accounting system in a business.

All the transactions happening in a financial year in any business, are recorded by debiting and crediting the relevant accounts.

These transactions are triggered by normal business processes by adjusting entries or charging customers.

While some businesses still perform manual accounting, most businesses today, especially large corporations with multiple locations and complex and voluminous transactions have switched to accounting software.

What is General Ledger?

The general ledger is the accounting book that contains a summary of all financial transactions of a business in a specific format for a specific period, and it helps to determine the closing balance as on the last day of that period.

ALSO READ: Physical Stock Verification and Its Advantages

What is Ledger Account?

A ledger account contains the record of every transaction with regard to a specific account within the general ledger.

Individual transactions within the ledger account are recognized with unique transaction numbers, dates, and descriptions which clarify the nature and reason of the transaction.

Each account that the business deals with has an individual ledger account that contains a summary of the account, or the closing balance for that specific period.

Bank, cash, debtors or accounts receivable, creditors or accounts payable, fixed assets, taxes, loans, salaries, profits, etc. are some examples of common ledger accounts.

What is Ledger Accounting?

It is simply a record or account of book-keeping entries that help prepare income statements and balance sheets.

There are three main types of ledger accounts – nominal, real, and personal.

Nominal accounts contain accounts that deal with expenses, incomes, losses, and gains.

Examples are purchases, sales, salaries, commissions, and similar accounts.

Real accounts contain accounts of assets and liabilities like accounts payable, fixed assets, prepaid expenses, cash, debts, loans, and accounts receivables.

Personal accounts contain accounts that are related to transactions with individuals and organizations with whom your business transacts directly.

Customers, vendors, business owners’ capital accounts, etc. are examples of personal accounts.

ALSO READ: What is Goods Received Note and Why is it Important?

Types of Ledgers

The three main types of ledgers are:

- Sales Ledger

- Purchase Ledger

- General Ledger

The Sales Ledger is where a business records all transactions related to the sales of their goods and services, and the cost of the products sold to customers.

It provides an idea about the revenue from sales.

The sales ledger also offers item details, transaction date, the amount sold, and if the sales were cash sales or credit sales.

Most businesses prefer to maintain this information on a monthly basis though it can be done quarterly and annually as well.

The value of the transactions is more important than the volume.

ALSO READ: ERP vs CRM

A ledger only contains data for a single company.

In case there are subsidiary companies, separate ledgers are maintained.

Likewise, credit sales information is maintained in a separate ledger than the cash sales ledger.

The Purchase Ledger is where a business records all transactions related to the purchase of raw materials, services, goods, and accessories from other businesses, and offers visibility into how much money the business pays other businesses.

This ledger basically contains details about all such items purchased along with the quantity, cost, and date.

Just like sales ledgers, the purchase ledgers can also be on a monthly, quarterly, or annual basis, depending on your preference, and considering the frequency of purchases.

Also, a sub-ledger for credit purchases is helpful in knowing how much you owe and their due dates.

ALSO READ : Benefits of ERP in Accounting and Financial Management

General Ledger is of two types, nominal and private.

We have already seen that the nominal ledger contains information related to income, expenses, insurance, depreciation, etc.

The private ledger contains information like salaries, wages, capital etc.

It is not accessible to everyone, and hence private.

Basically, all entries that cannot be posted to any other ledger, are posted to the general ledger.

Journal Vs Ledger In Accounting

Often people confuse the two terms and use them interchangeably.

It’s true that both these books of account are important, and eventually help in determining the financial status of a business.

ALSO READ: Benefits of Blockchain in Cloud Computing

Let’s look at journal vs ledger to understand the differences.

- Journal is the minor or subordinate book of accounts used for documenting transactions whereas ledger is the main accounting book. It classified journal entries (transactions) based on their nature.

- Transactions in a journal are recorded in the chronological order as they happen, whereas in the ledger, the journal transactions are organized under individual accounts.

ALSO READ: Important ERP Modules and Functions

- Journal entries contain complete transaction details which is not seen in the ledger.

- The ledger provides the result of transactions which is missing in the journal.

- Balances from various ledgers help to prepare financial statements of a business-like profit and loss account and balance sheet whereas the journal has no direct role in the creation of these statements.

The Benefits of a General Ledger

The ledger books offer several benefits, like

- Help to understand the status of the business at any given time; a cash ledger reflects the available cash on a date, for example.

- It aids in performing bank reconciliation as all transactions for an account at a bank are available in one place.

- As ledgers are classified at the time of their setup by a business, they can get a look at say all their debtors or all creditors quickly.

ALSO READ: What is Landed Cost and How to Calculate It?

- General ledger offers an overall view of an organization’s transactions to auditors, who can analyse them to gain a clear picture about the business.

- It facilitates the proper organization of accounting and helps in the preparation of trial balances – a precursor to the preparation of the profit and loss statement.

Steps to Prepare the General Ledger

Posting

Posting refers to the practice of shifting journal entries, both credit and debit, to classified accounts in the ledger.

There are certain rules to be followed for posting which have to be followed without which you are not likely to get a true picture of the business or prepare the financial statements accurately.

Rules for Posting of Entries in the Ledger Accounts:

- Each account needs its own individual account in the ledger

- To or Dr is used in the Particulars column when the account is on the debit side and By or Cr is used when the accounts are on the credit side. For example, when you have paid a vendor X SAR 1000, the entry will be: By X 1000, or Dr X 1000. The interest received on deposit will be entered as To Interest 2500, or Cr Interest 2500.

- The account debited in the journal has to be debited in the ledger with the reference of the relevant credit account.

ALSO READ: Complete Guide on Economic Order Quantity

Balancing an Account

Closing balance is derived at the end of every month, and at the end of the financial year.

However, you can do it on any given day if required for an audit or any other reason.

This is a simple process.

Let’s suppose you have purchased raw materials worth SAR 30,000, and you have paid your supplier SAR 12,000.

The closing balance against this vendor is SAR 18,000.

It will become part of your accounts payable.

To calculate the closing balance, all you have to do is sum up both sides and find the difference – this is the closing balance.

The account has a credit balance if the credit side is more than the debit side; it will have a debit balance if the debit side is more.

ALSO READ: Debit notes Vs Credit Notes

Credit balance is usually expressed on the debit side as ‘To Balance c/f’, meaning carried forward.

This balances both sides.

When the accounting for the new period starts, this becomes ‘by Balance b/f’, or brought forward, and is the opening balance for the same.

It will be written on the credit side.

The same process is followed if it is a debit balance; the balance is carried forward and written on the credit side, balancing both sides.

Then for the new period, the balance is brought forward and written on the debit side.

Procedure for Writing Ledger

Though accounting software is used by most businesses today, you can create your own general ledger.

Accounting software posts every financial transaction straight to the general ledger.

ALSO READ: Complete Guide to Cash Flow Analysis

Step 1: Create Ledger Accounts

Separate ledgers need to be maintained for separate accounts.

Cash ledger will contain all cash transactions of the business.

Unexpected expenses are normally included in the general ledger account.

The basic ledger account types are Income, Expenses, Assets, Liabilities, and Other Income and Expenses (usually not directly related to the business); some may also include Equities.

Make a list of accounts you need within each account type.

You can create Accounts Payable, and loans under Liabilities, for example.

Step 2: Create Columns

On the left side you can have columns for journal entry number, date, and description.

On the right side, make columns for debit, credit, and running balance.

Debits enhance asset and expense accounts, reducing liability and revenue.

Credit entries enhance liability, revenue, and equity, decreasing assets and expenses.

Basically, credit is what you have paid or is owed to you, and debit is the money you owe or receive.

ALSO READ: Demand Forecasting and Its Importance

Step 3: Recording Financial Transactions

Record every business transaction as it happens on a daily basis. Post journal entries to the relevant ledger immediately.

Step 4: Prepare the Trial Balance

Make a summary of the closing balances from the general ledger and display the totals of each account to prepare the trial balance report.

Once these are matched, you can use them to prepare the financial statements.

In accounts, the double-entry system is followed where every financial transaction has an impact on two separate ledger accounts, and each entry being recorded in two columns.

The debits are posted on the left, and the credits are posted on the right side of the ledger.

The total of all debit and credit entries have to balance.

ALSO READ: What is Zero Inventory and Why it is Important?

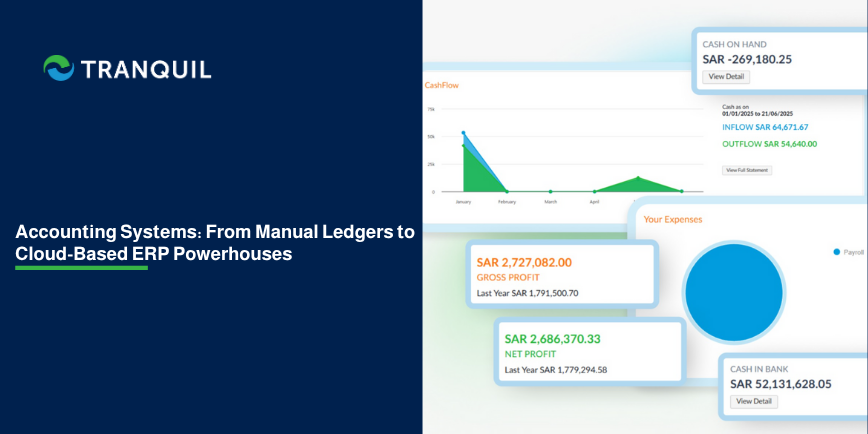

Automation Eases your Work

As you can see, doing all of this manually not only takes time but effort as well.

Additionally, you may even have several errors.

A much better option is to take the digital route. Implement a top-class ERP solutions like Tranquil, and its robust finance and accounting module will do all this and much more for you.

Streamline your entire accounting process and classify transactions accurately with our ERP software.

Focus your energies on core business activities that add value and accelerate growth.

Do schedule a demo of Tranquil Cloud ERP at your convenience, and we’ll be happy to show you how it can benefit your business.