Saudi Arabia Makes Electronic Invoicing Mandatory – Detailed Guide

Electronic invoicing refers to the procedure of switching over to electronic processes for issuing invoices, from the conventional manual, paper-based invoices, and debit and credit notes. The process aims to facilitate the processing and exchange of invoices and debit and credit notes in a systematic, electronic form between sellers and buyers.

FATOORAH is the name given to the e-invoicing project in the KSA. It is applicable for B2C, B2B, as well as B2G transactions.

You can Schedule Demo

The Authority in Charge of Implementation

The Zakat, Tax and Customs Authority, or ZATCA is the authority that has been given the charge to implement and administer the VAT, or tax, in Saudi Arabia. This organization has the authority to do the following:

- Registering and de-registering taxable individuals for VAT

- Administering the filing of VAT returns and refunds

- Conducting audits and field visits

- Power to penalize individuals or companies for non-compliance of regulations

- Implement the electronic invoicing framework in Saudi Arabia

The Zakat, Tax, and Custom Authority (ZATCA) of Saudi Arabia had announced on December 4th 2020, that an electronic invoice will be made compulsory for all resident tax payers in the country in the following year.

This extends to third parties who furnish invoices in the name of taxpayers, subject to VAT. Only companies not resident in KSA do not fall in the ambit of this regulation.

More details were published by the Authority on 28.05.2021, outlining the technical specifications, rules for each phase, and detailed requirements with regard to e-invoices and related documents.

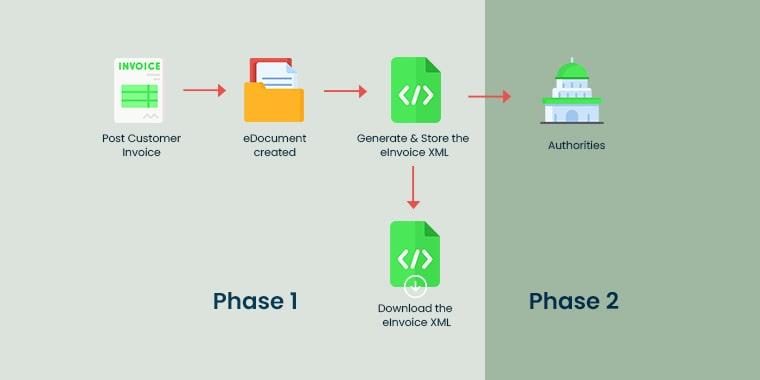

December 4th 2021 is the day chosen for the rollout of this new regulation. The ZATCA declared that this rollout will be implemented in two phases.

As per the regulation, resident taxpayers need to be fully capable to not just issue, but also save and alter e-invoices by the specified date.

The regulations contain specific terms and conditions and requirements with regard to e-invoices, as well as e-credit and debit notes. It must be borne in mind that these regulations will be subject to the provisions related to tax invoices as stated in the VAT legislation. Penalties will be levied on those who do not comply with the regulations.

Along with VAT and the e-invoice regulations, sections with regard to proof of e-transactions and e-signatures as stated in the Electronics Transactions Law will also be applicable to the e-invoices and electronic credit and debit notes that are issued.

Key Provisions of the New Regulations

Businesses operating in Saudi Arabia, must bear in mind these important points:

- From 04.12.2021, e-invoices must be issued – this is the first phase

- The second phase will be rolled out later, and in this phase, taxpayers should link their system for issuing electronic credit and debit notes, and invoices, with the ZATCA systems so that critical data can be easily shared and accessed

- It is necessary to issue electronic invoices in Arabic primarily; additionally, other languages like English, may be used.

- The provisions are applicable to all supplies that are taxable – subject to the standard or 0 rate of value added tax; the provisions are also applicable to consumers both within and outside the country (if sales happen outside Saudi Arabia)

Why is the KSA Government Implementing e-invoicing?

Saudi Arabia is not the first country to move to electronic invoicing; in fact, it is following the global trend of doing away with paper invoices.

It is a natural progression of the modern economy, and the system of electronic invoicing will help in the modernization of the country’s tax infrastructure, help the authorities control more effectively, while diminishing the cost of administration.

Seeing how other countries have benefited from electronic invoicing systems, Saudi Arabia has also decided to modernize its invoicing and tax systems.

Electronic invoicing can bring in a sea change, and offer numerous benefits, which are to do with:

1) Security, and 2) Efficiency

With electronic invoices, the government will be able to identify and track the movement of money, goods and services in real time.

This will have the effect of increased tax compliance, greater transparency on commercial transactions, and data-driven, informed decisions.

Electronic invoices can result in more efficient, smooth trade, leading to hassle-free transactions, quicker payments, and decreased expenses, delivering in-depth and exhaustive insights into market dynamics.

In turn, this facilitates fair competition while boosting competitiveness among businesses, and providing greater protection in the market, in sync with best practices globally.

Phases of the FATOORAH e-invoicing Project and Important Dates

Phase 1 : December 4th 2021

From this date, manual, handwritten or types/printed invoices will be unacceptable. It will be mandatory for taxpayers to issue e-invoices and relevant electronic notes with a compatible system that enables the necessary fields to be displayed in the e-invoice. This phase is to be utilized by those covered by the new regulation, to prepare for phase 2.

The system should also be capable of archiving, and issuing a copy to the client. These fields must be mandatorily included in the e-invoices in the first phase:

- The purchaser’s VAT number (if a registered taxpayer who has to compulsorily issue invoices)

- The date of the issue of the invoice and VAT

In addition to those, B2B invoices can contain QR codes (optional) but on simplified invoices used in B2C invoices, it is mandatory.

Taxpayers need to ensure that they implement certain security measures for their invoice generation systems, like preventing data manipulation, requiring stringent authentication for accessing data, ensuring that the counter for sequential numbering of invoices cannot be reset, among other things.

Phase 2 : January 1st 2023

In the ‘Integration Phase, it is mandatory for every invoicing system to be compatible with the system used by ZATCA, and this integration will be performed gradually, depending on the class of taxpayer.

Taxpayers will be notified a minimum of 6 months prior to the date of mandatory integration. In this phase, taxpayers must follow these norms:

- All e-invoices, like simplified tax invoices etc., and the relevant papers must be created and issued in PDF or A3 format with XML, or simply XML.

- The taxpayer should be able to get online and via the ZATCA API, integrate with outside systems.

- Generating a QR code and hash, a unique universal identifier, and a digital signature are to be compulsorily implemented to ensure the authenticity of the invoices and prevent tampering with them.

The Zakat, Tax, and Custom Authority has defined what its e-invoicing system is like, and what the technical specifications for the e-invoices should be.

It is recommended that businesses take the initiative to migrate to the new e-invoicing system as soon as possible.

In phase 1, taxpayers can venture into the new system and familiarize themselves with it, allowing them to lay the foundations for an efficient system compatible with the official system of ZATCA.

The invoices are required to go through the ZATCA e-invoicing platform, for which you need to use the API integration tool of the system to connect your system to the central platform.

Benefits and Advantages of e-invoicing

Adopting an electronic invoicing system offers innumerable benefits for the country as a whole, and for the individuals subject to the regulations. Here we enumerate some of the most significant ones:

- Ensuring fair competition and consumer protection by implementing an amalgamated process for auditing and corroborating invoices, thereby improving the business ecosystem.

- Minimizing parallel economy transactions

- Minimizing fraud, purposeful omission or concealment of transactions by increasing regulations for tracking invoices and retaining data

- Enhancing customer experience, and digitizing the relationship between customers and vendors

- Improved compliance with tax regulations via more effective authentication of business transactions.

- Saves time, as unnecessary steps are removed from the invoicing process

- Reduce expenses as you no longer have to pay courier charges for mailing invoices, or for printing them

- Minimize use of paper

- Affords better control and offers deep insights into the invoicing process, as all information is stored on a single unified platform, that can be accessed regardless of location or device. It gives an overview of invoicing with automated and inbuilt reports and analytics.

How to Fulfil the Technical Requirements?

Any business falling in the ambit of the regulation can approach reputed software vendors or electronic invoicing solution providers to build compliant e-invoicing solutions. Those with full-fledged IT teams in-house should have no major issues in fulfilling technical requirements.

Tranquil is a prominent cloud-based ERP software system that helps you to manage your projects and business work in a hassle-free way. Moreover, with this software, you can access your business data anywhere, any time. If you want to management ERP software system, you can get in touch with Tranquil software.