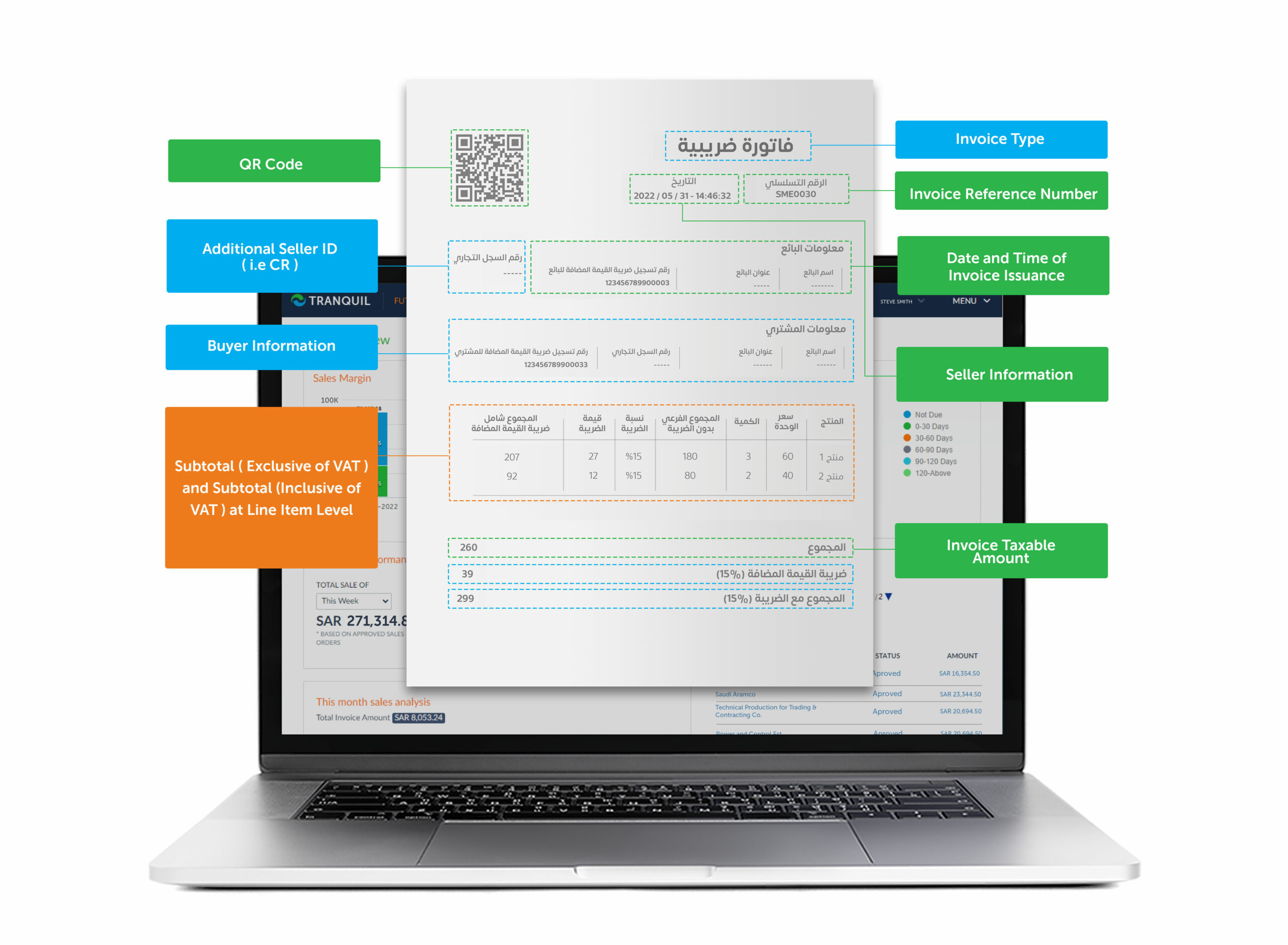

E-INVOICING (FATOORAH) IMPLEMENTATION IN KSA

ZATCA has published e-invoicing requirements that will be rolled-out into two main phases in KSA:

Roll-out Phases

PHASE 1 (as of December 4th, 2021)

Phase 1, known as the Generation phase, will require taxpayers to generate and store tax invoices and notes through electronic solutions compliant with Phase 1 requirements.

Phase 1 is enforceable as of December 4th, 2021, for all taxpayers (excluding non-resident taxpayers), and any other parties issuing tax invoices on behalf of suppliers subject to VAT.

PHASE 2 (Enforceable Starting January 1st, 2023 in waves)

Phase 2, known as the Integration phase and rolled out in waves by targeted taxpayer group, will involve the introduction of Phase 2 technical and business requirements for electronic invoices and electronic solutions, and the integration of these electronic solutions with ZATCA’s systems.

ZATCA will notify taxpayers of their Phase 2 wave at least six months in advance, and the enforcement date for the first target group will not be earlier than January 1st, 2023.

Source : ZATCA