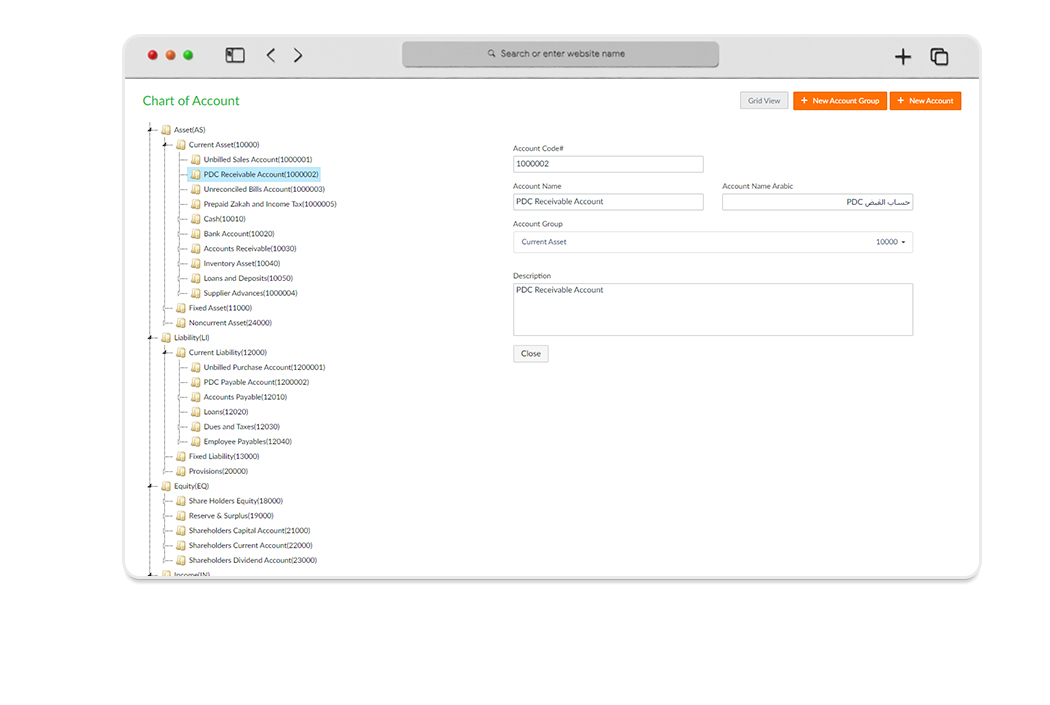

Having the right chart of accounts makes a huge difference for your organization. It helps you classify your transactions correctly, and generate meaningful reports to help you run your business more efficiently.

Tranquil Financial Management Software assigns your organization a default chart of accounts when you start on Tranquil. We can even import a chart from your previous accounting system, or generate your own custom chart.

The Chart of Accounts includes all the accounts you need to track for your small business: assets, liabilities, equities, income and expenses.

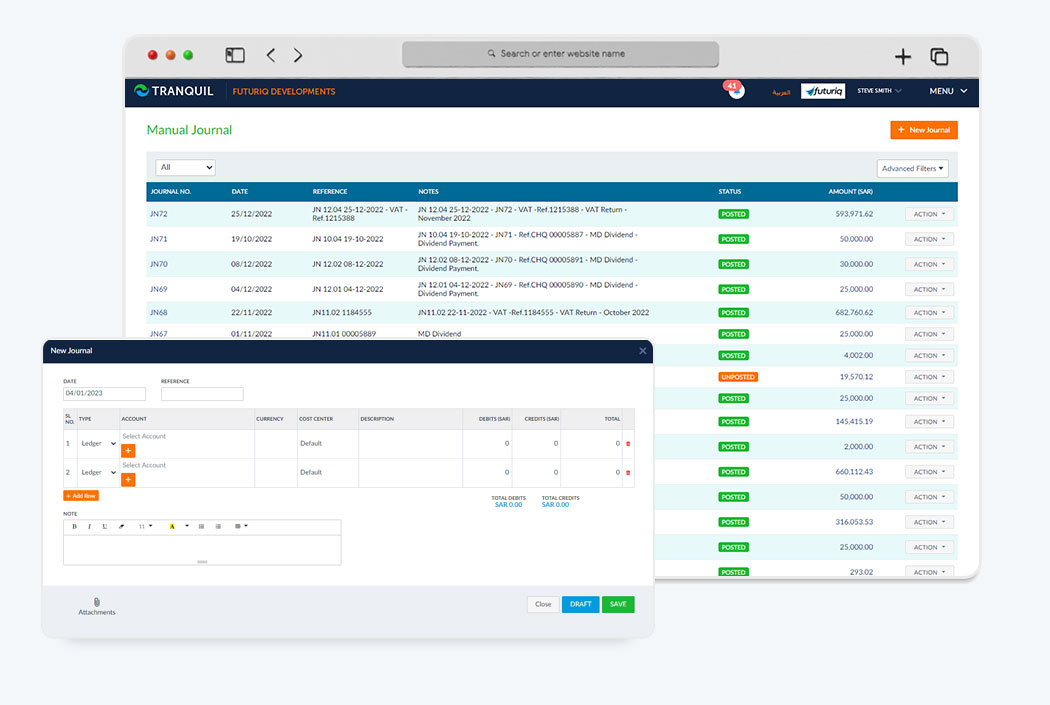

Using Tranquil accounting software post/Unpost allows users to edit the journals before it affects the finances.

This allows the accounts managers to make decisions on what expenses are to be paid and when.

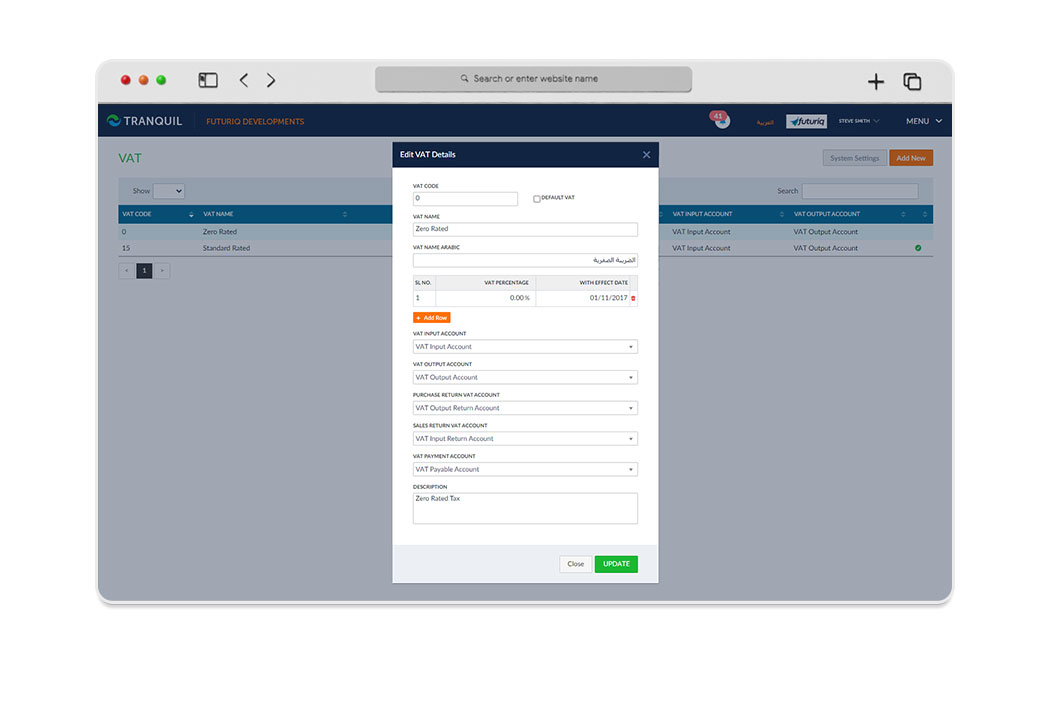

Our VAT accounting Software automatically generates VAT return in one click and keeps track of how much tax is received or owed.

With full support for Tax calculation, now you only have to apply the tax rate in the tax settings and Tranquil will calculate the tax breakdown.

Tranquil Tax process is optimized to be in compliance with Saudi laws.

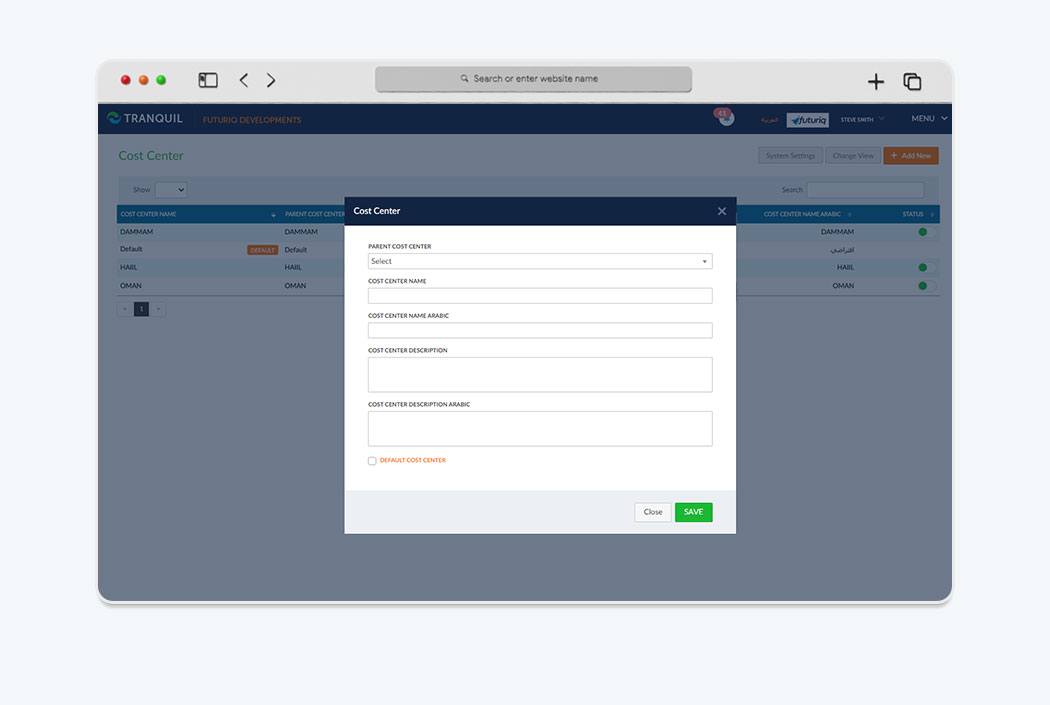

The cost center in Tranquil Financial Management software refers to an organizational unit to which costs or expenses can be allocated during transactions. For example, you can use the cost center to see the effectiveness of each project.

Keeping track on a cost center allows you to manage expense and income efficiently.

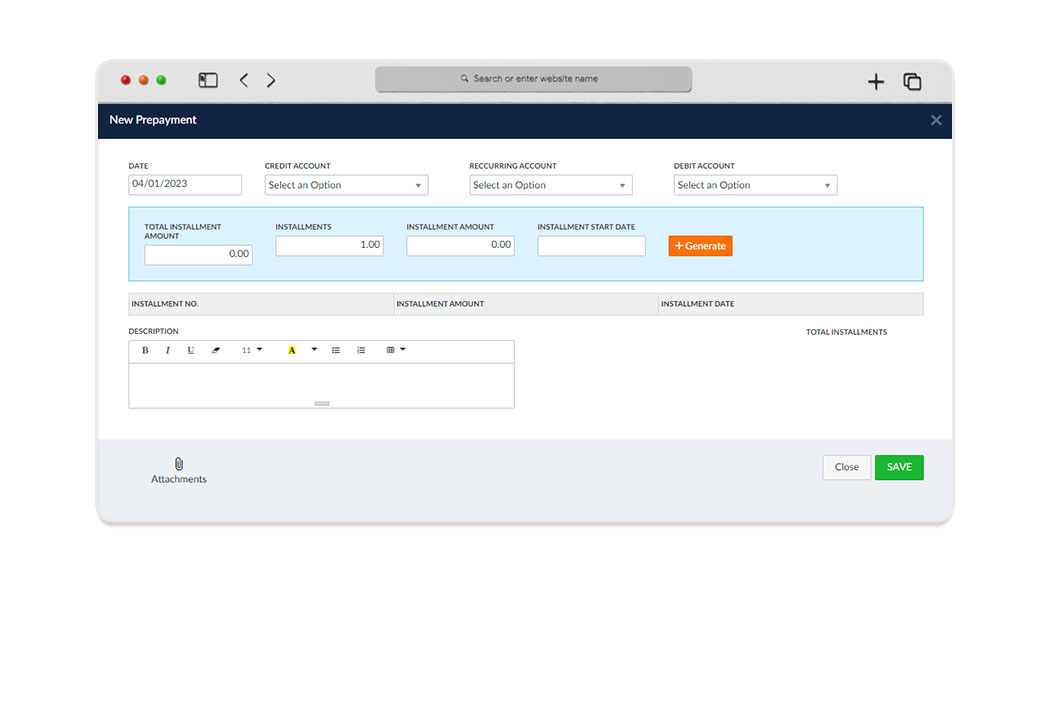

Prepayments are amounts paid in advance for goods and services and comprise both Expense and Asset components. As such, it is important to know when and how to reflect prepayments in the Profit & Loss statement. Businesses prepay their expenses all the time. Most of the common examples are:

- Prepaid insurance

- Prepaid rent

- Prepaid advertising

- Prepaid royalties

- Supplies. etc.

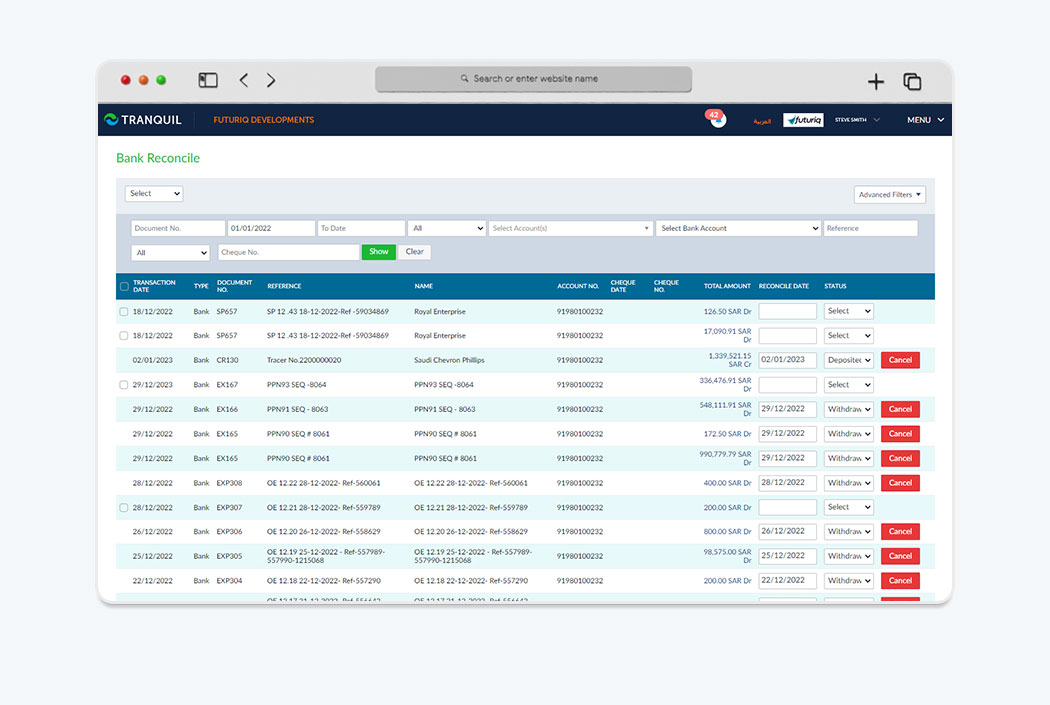

With Tranquil Financial Management software, bank Reconciliation matches the balances in a company’s accounting records with the corresponding bank statement. Its purpose is to detect any and all discrepancies between the company’s accounting records and that of the bank’s other than those due to in the time they were recorded.

It’s extremely important to perform regular bank reconciliation to ensure that the recorded cash is correct, to avoid overdraft fees, to keep a check on bounced, stolen, or altered checks, and any other fraudulent activities.

With regular reconciliation, any unforeseen problem or error could be detected and resolved in time.

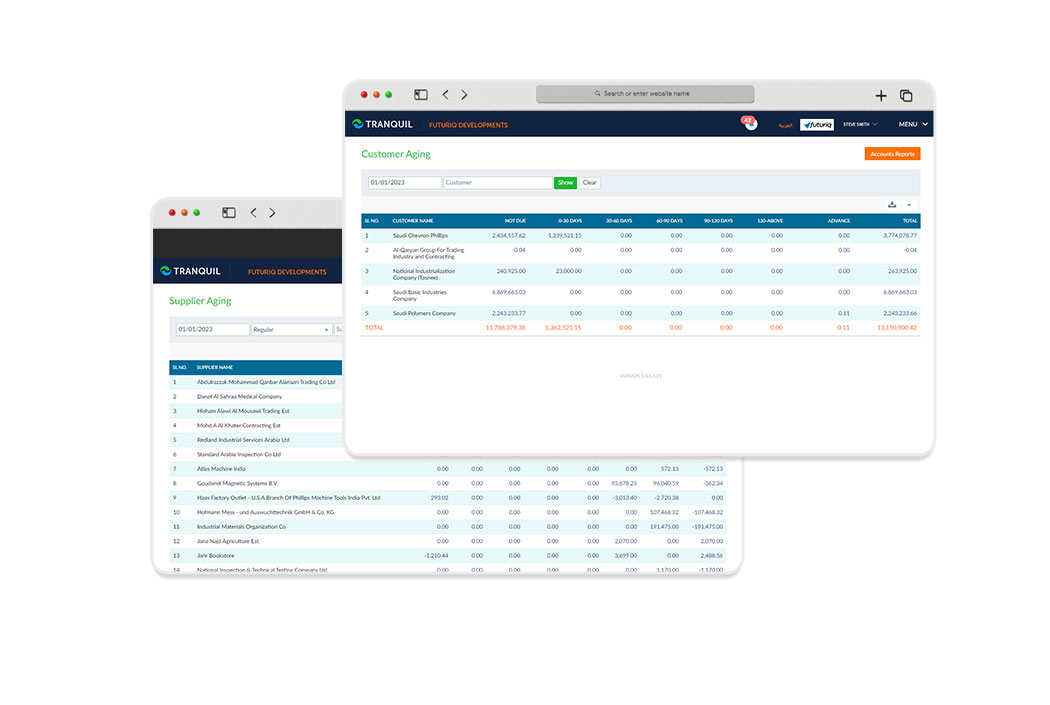

In accounting the term aging is often associated with how much money is coming into your business and what is owed.

In order for the company to minimize its cash flow problems and potential losses from customers who are unable to pay, Tranquil accounting software routinely prepares an aging of accounts receivable which allows managers to quickly see which customers are behind in meeting the terms agreed upon.

A/P payable or supplier aging is particularly useful if your cash flow is tight and you cannot pay your invoices on time. You can refer to it and decide who should get paid now and which payments can be delayed.

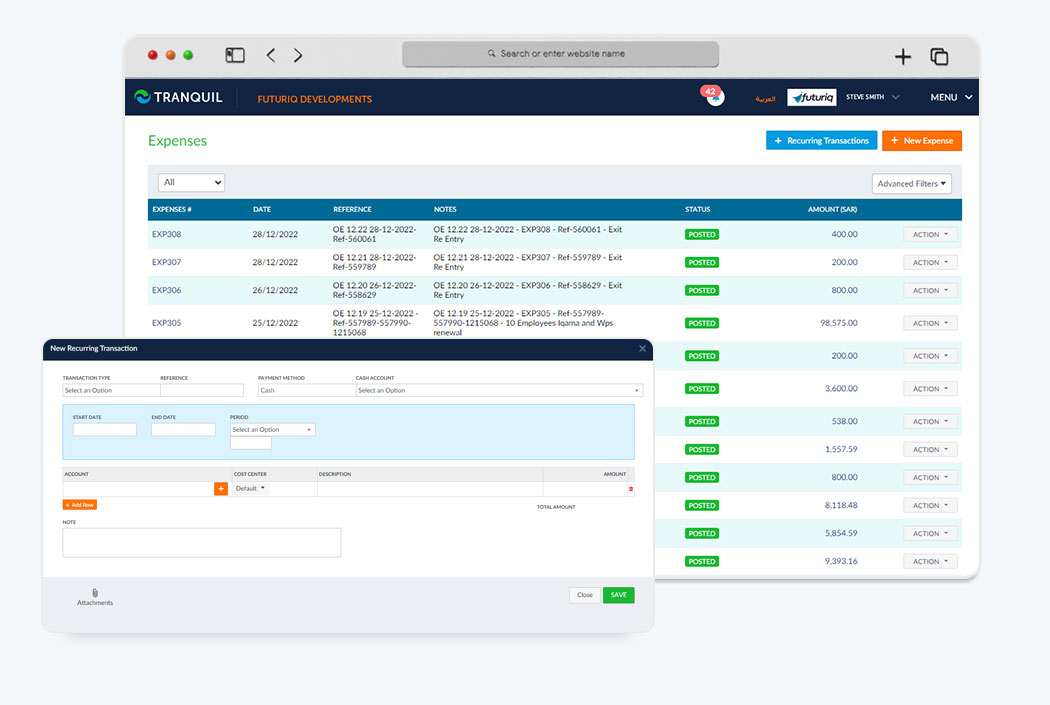

If you have expenses and receipts with regular billing such as monthly charges, amortization, pre-paid expenses, rent payments etc., you don’t have to enter the same information every time. Simply create one expense and receipt voucher with a recurring option, and specify how often it should recur.

Tranquil Finance Management system helps you to generate all of your company’s recurring expenses and receipts with just one click.

It is well worth the initial setup time to save you hours of precious time and avoid a endless repetitive work in the future.